Can you backdate car insurance coverage is a question many drivers ask after an accident or traffic incident without active insurance. The short answer is usually no, but the full explanation is more complex. Understanding why insurance companies rarely allow backdating and what your real options are can save you from financial and legal trouble.

Why Can You Backdate Car Insurance Coverage Is Rarely Possible

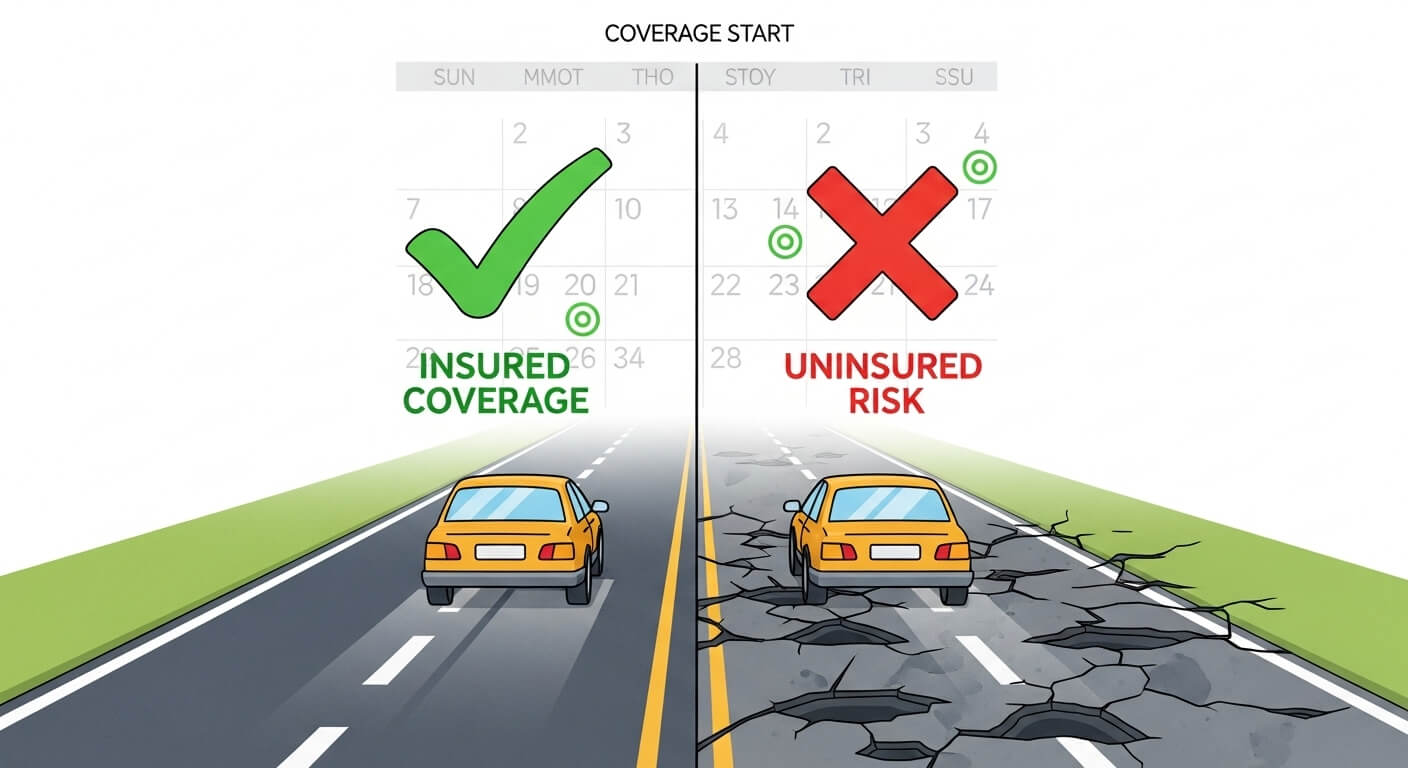

Car insurance works on a risk-based principle. Insurers take on the risk from the moment your policy starts, not retroactively. Backdating coverage would allow someone to sign up after an incident, which defeats the purpose of risk assessment and premium calculation. In most regions, doing so would also be considered fraud.

Legal Implications of Backdating

Attempting to backdate your auto insurance can carry severe consequences. In some states, falsifying policy start dates is illegal and could lead to criminal charges. Even if a company were willing to consider it, you might be required to provide documented proof of an administrative error, such as a missed payment due to bank error or an oversight in processing your application.

Situations Where It Might Be Considered

In rare cases, backdating might be possible if there was a genuine clerical mistake by the insurance provider or agent. For example, if you applied for coverage on Monday but the system shows the policy starting on Wednesday, they may correct the effective date to Monday. However, this is not the same as backdating to cover an already known accident.

Alternatives to Backdating Car Insurance

If you find yourself without coverage, your best option is to secure a new policy immediately rather than trying to backdate. You can also explore non-owner car insurance if you frequently drive but don’t own a car. For more detailed explanations of coverage options, you can visit reputable insurance resources such as National Association of Insurance Commissioners

How to Avoid Gaps in Coverage

Preventing a lapse in insurance is far easier than trying to fix it after the fact. Set reminders for renewal dates, use automatic payments, and communicate with your insurer if you’re facing financial hardship. Many companies offer grace periods for late payments, which can help keep your policy active.

Final Thoughts on Can You Backdate Car Insurance Coverage

While you may hope for a quick solution, in most cases, you cannot backdate car insurance coverage. Instead, focus on proactive steps to maintain continuous coverage. This not only keeps you legal but also protects you financially from unexpected accidents.

FAQs

Can you backdate car insurance coverage after an accident?

In almost all cases, no. Backdating after an accident is considered fraudulent.

Is there any legal way to backdate car insurance?

Only if it’s due to an administrative error or processing mistake by the insurer.

What happens if I drive without insurance?

You may face fines, license suspension, and personal liability for damages.

How can I avoid a lapse in my insurance?

Use automatic payments, track renewal dates, and communicate with your insurer.